Background

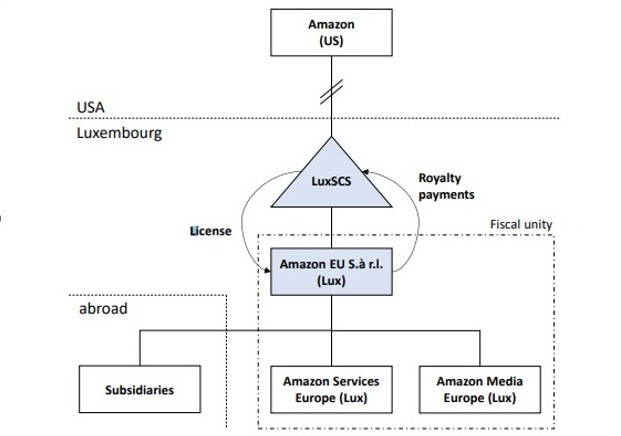

In 2003, the Luxembourg authorities issued a tax resolution accepting the Amazon group’s proposal for restructuring two companies located within this region to transfer most of the profits from Amazon EU, the subsidiary paying taxes, to Amazon Europe Holding Technologies (AEHT), a group company not subject to pay any taxes. Both companies are owned by the Amazon group and are controlled by the American parent company, Amazon.com, Inc.

During 2006, the restructuring was effective through a tax resolution, which allowed the use of license agreements to come into effect, thus entitling AEHT to use these intangibles in exchange for a payment to Amazon EU.

European Commission (EC) Investigation Process

During 2014, the EC initiated an investigation process, requesting information on these advance tax decisions given by the Amazon group. Within this investigation framework, the EC requested the Luxembourg authorities and Amazon various information to analyze the legality of Amazon’s internal structure between 2006 and 2014.

This investigation revealed that the amount of royalty payments approved through tax resolution was high and did not correspond to the reality of the market. Consequently, the EC determined that Amazon benefited from a tax agreement with Luxembourg, paying lower taxes compared to other companies subject to the same tax laws in the country, which had to collect around €250 million in taxes.

According to the EC, the use of license payments decreased the tax base of the company that recorded these expenses, thus also those of the Amazon group in Luxembourg and Europe.

Position of the General European Union Court (GEUC)

The Luxembourg tax authority and Amazon challenged this decision before the GEUC. In May 2021, the Court declared that the EC did not have sufficient support to argue that the Amazon group subsidiary had benefited from an undue reduction in its tax burden. Thus, Luxembourg had not granted any selective advantage to that subsidiary, and the Commission’s Decision was annulled.

The GEUC determined that the EC erroneously recognized the Arm’s Length principle in Transfer Pricing, which evaluates whether intragroup transactions are at market conditions. Given that this principle is not autonomous in the EU law, the Commission can only resort to it if incorporated into Luxembourg tax law. Likewise, the Organization for Economic Cooperation and Development (OECD) Guidelines may only be practically significant in intra-group transactions if Luxembourg tax legislation refers to them explicitly. Therefore, the EC had wrongly determined the “Reference System,” which is the first phase in the analysis to classify it as state aid.

In many situations, cases of state aid in tax matters often fail because the selective nature of an advantage granted to a company cannot be demonstrated. Thus, the GEUC had to revoke the EC’s final ruling due to errors in the application of that reference system.

Conclusion

The closure of the Amazon case joins other cases related to state aid, such as those of Starbucks and Apple, in which the GEUC has kept a consistent approach.