The Annual Affidavit N°1951 or “Local Report” is mandatory for certain taxpayers in Chile. This statement focuses on significant transactions carried out by local companies with related parties abroad. Filing this statement is essential to comply with the regulations established by the SII (Servicio de Impuestos Internos – Internal Revenue Service) of the country.

1. Filing Requirements

Taxpayers required to file the Affidavit N°1951 must meet the following conditions as of December 31 of the reporting year:

- To belong to the Large Companies segment.

- The parent or controlling entity of the Multinational Group of Companies must have filed the Country-by-Country Report to the SII or other Tax Administration for the respective year.

- To have carried out operations with related parties abroad exceeding CLP 200,000,000 (or its equivalent in foreign currency).

2. Content and Details of the Statement

Affidavit No. 1951 requires detailed information on the relevant transactions performed by the local taxpayer with related parties abroad during the reported business year. The key aspects to be considered are:

- Identification of the Declarant: The RUT (Registro Único Tributario – Single Tax Registration Number), name or corporate name, location, email address, and telephone number of the taxpayer must be provided.

- General Background of the Declarant: It includes the number of areas, total number of employees, business reorganizations or transfers of intangible assets that have influenced the taxpayer, as well as advance pricing agreements within the multinational group.

- Detail of Transactions: Each foreign-related party transaction exceeding CLP 200,000,000 must be specified. This includes details such as the name of the counterparty, transaction code, and amount of the transaction, among others.

- Economic-Financial Information: This section involves the filing of the individual income statement of the taxpayer, detailing operating income, costs, gross income, administrative expenses, depreciation, operating income, and reported financial income to entities abroad, if any.

3. Filing Deadline

Affidavit No. 1951 must be filed until the last business day of June of each year. Regarding the transactions within the Transfer Pricing scope performed during the immediate previous business year. In this regard, the taxpayer may request a one-time extension for up to three months. Such an extension must be requested before the original due date, specifying the grounds for it.

4. Penalties

The fine for the taxpayer failing to file the aforementioned affidavit, or filing it erroneously, incompletely, or untimely, will range from 10 to 50 UTA (Unidades Tributarias Anuales – Annual Tax Units established at the date the infraction is processed), which may not exceed the highest limit between the equivalent of 15% of its own capital, determined pursuant to Article 41 of the Income Tax Law, or 5% of its effective capital.

Specifically, the following is established:

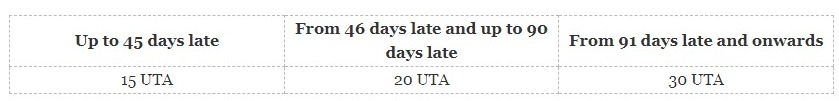

Untimely Affidavit: The fine will be applied progressively, considering the delay of the filing.

Unfiled Statement: The fine will be equivalent to 50 UTA for unfiling taxpayers detected by the SII.

Incomplete or Erroneous Affidavit: The penalty will be imposed if the corresponding rectifying statement has not been filed.

- The fine will be 10 UTA for each untimely or extended rectifying statement filed, up to a maximum of 50 UTA.

- If the SII detects the incomplete or erroneous statement filing and the taxpayer has not filed a rectifying statement, the fine will be 30 UTA for each statement.

5. Conclusion

The Annual Affidavit N°1951 (Local File) is mandatory to comply with tax regulations in Chile. The thorough filing of this statement, providing accurate data on relevant foreign-related party transactions, is essential for tax compliance. Taxpayers subject to this obligation must ensure the filing of the required information accurately and under the SII deadlines to avoid possible penalties.

Additionally, it should be noted that by the recent restructuration of the Large Taxpayers Directorate, the SII aims to strengthen its strategy of auditing large business groups, which generate the highest percentage of tax collection in Chile and are precisely within the scope of the Annual Affidavit No. 1951.