Although business restructuring responds to several factors, it also entails a profit reallocation among the entities within an economic group, either immediately after the restructuring or throughout a certain period.

According to OECD guidelines, the profits obtained by the entities involved after the restructuring process must be aligned with the functions, assets, and risks assumed by the companies (FAR analysis) and must comply with the Arm’s Length principle.

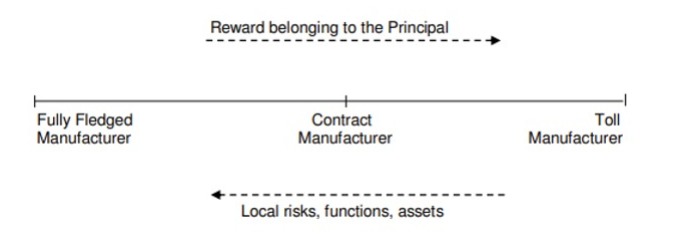

Some distribution models from the Transfer Pricing perspective are presented below:

Sales models

Sales or distribution represents the process by which a product/service goes through the entire commercial process until reaching the final consumer. There are different types of distributors (depending on the functions performed, the risks assumed, and the assets used), as shown below:

These restructurings may involve the international transfer of valuable intangible assets, but there are exceptions.

A business representative is an intermediary who organizes the sale of products to the customer for and on behalf of the principal, while the latter is the owner of the goods and usually signs the sales contracts (there is no inventory risk for the commissionaire). The remuneration for the activity performed by the business representative is usually based on the cost-plus method (assuming the CUP method cannot be used) or on a commission (percentage) on sales.

The commissionaire is similar to the commission agent, except that the former sells the goods for the principal but on its behalf. The commissionaire does not become the owner of the goods and does not assume any inventory risk. The transfer prices used to remunerate a commissionaire may be determined through the resale price method or the transactional net margin method (assuming the CUP method cannot be used).

The limited risk distributor becomes the owner of the goods sold (immediately before the sale to the customer) and, therefore, assumes certain limited inventory risks. In addition, the distributor acts on its own behalf. Similarly to a commission agent, the transfer prices used to remunerate an independent buying/selling distributor can be determined by applying the resale price method or transactional net margin method (assuming the CUP method cannot be used).

Finally, the full-fledged distributor acts more autonomously than a limited-risk distributor, and the activity performed is decentralized with little or no control or central consistency.