Background

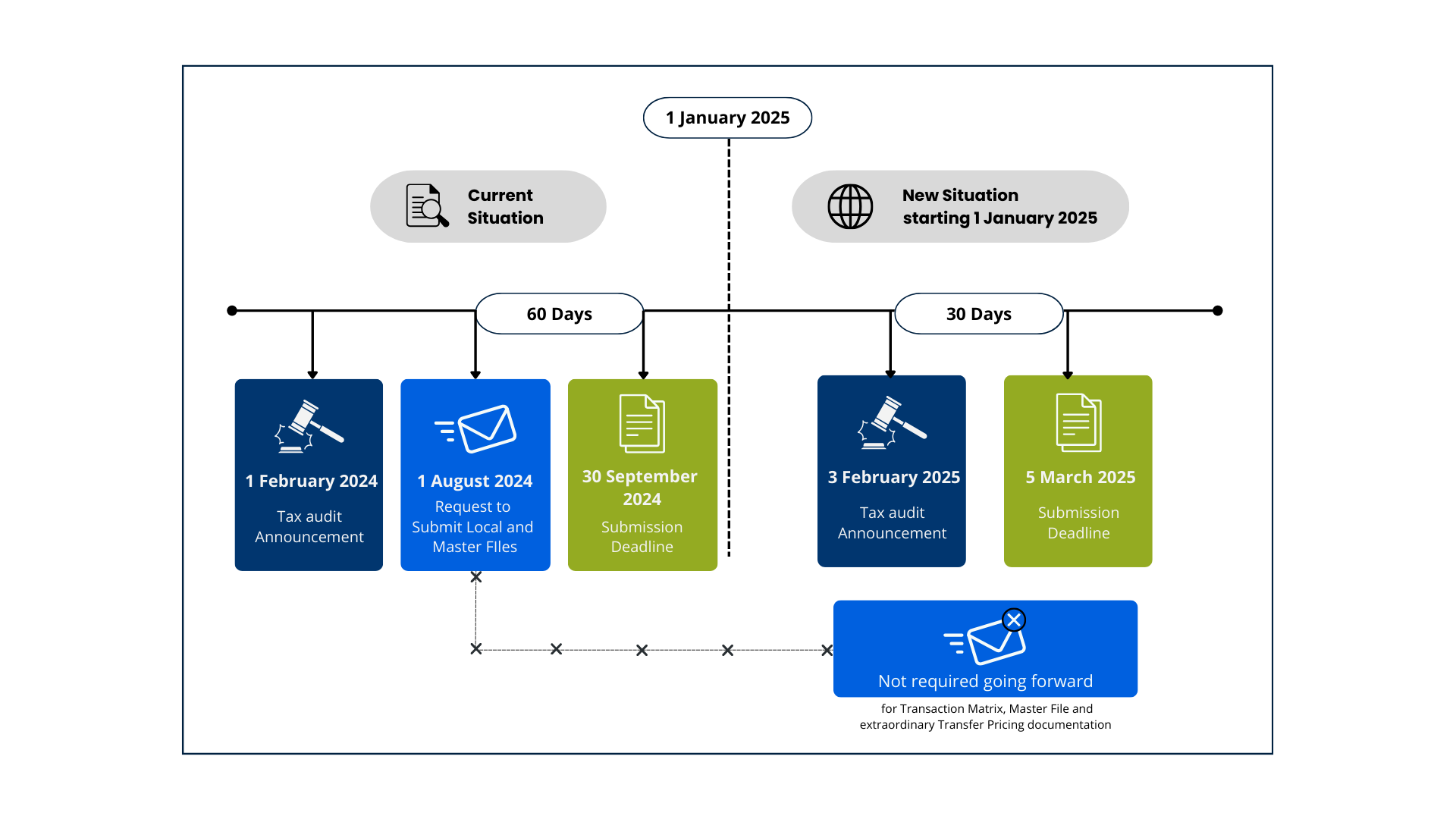

Germany introduced significant changes to the deadlines for filing Transfer Pricing documentation, which will come into force as of January 1, 2025. These amendments intend to improve transparency and tax compliance in related party transactions.

Context of the New Deadlines for Transfer Pricing Documentation in Germany

As of next year, companies must prepare and file Transfer Pricing documentation within a shortened timeframe. This new regulation will apply to all companies subject to German Transfer Pricing regulations, affecting the preparation of local and master files and other documentary evidence required to support intercompany transactions.

New Deadline Dates

The current deadline of 60 days for filing Transfer Pricing documentation in Germany, including local and master files, will be reduced to 30 days. The deadline for filing extraordinary Transfer Pricing documentation remains unchanged at 30 days. When documentation is requested out of a tax audit, the 30-day countdown begins from the date the taxpayer receives the filing request.

Key Details of the New Regulations

The new deadlines mean companies will have less time to file Transfer Pricing documentation. Previously, companies had more flexibility in filing these documents. Onwards, the deadline will be tougher to ensure a more accurate reflection of the tax period in question.

Consequences for Companies

Reducing deadlines represents a significant challenge for many companies, especially those with complex international operations. Implementing these stricter deadlines will require companies to optimize their information-gathering and preparation processes to ensure compliance without fines or penalties.

Compliance Recommendations

Given these changes, companies must adopt proactive measures to comply with the new provisions. Reviewing and updating internal control systems, training the team, and relying on the advice of Transfer Pricing experts are some of the actions recommended to ensure the documentation preparation on time.

Conclusion

The new Transfer Pricing documentation deadlines in Germany represent a major change in the regulatory framework, requiring companies to apply a tougher approach to preparing their reports.

At TPC Group, we have a team of Transfer Pricing experts who can assist you in adapting to these amendments efficiently.

Source: Alvarez & Marsal