On December 31, 2016, The Legislative Decree No. 1312 was published, which modifies the Article 32-A of the Income Tax Law, requiring the presentation of the Local Report as of fiscal year 2016, and the Master Report and Report Country by Country as of fiscal year 2017.

On January 18, 2018, The Superintendence Resolution No. 014-2018 / SUNAT was published, which approves rules for the presentation of the Local Report Informative Affidavit (Virtual Form No. 3560).

Finally, on June 29, 2018, the Superintendence Resolution No. 163-2018 / SUNAT, dated June 27, 2018, was published in the Official Gazette, which establishes the “Rules for the presentation of Declarations Information Juries Master Report and Country by Country Report (Virtual Forms N ° 3561 and 3562)”

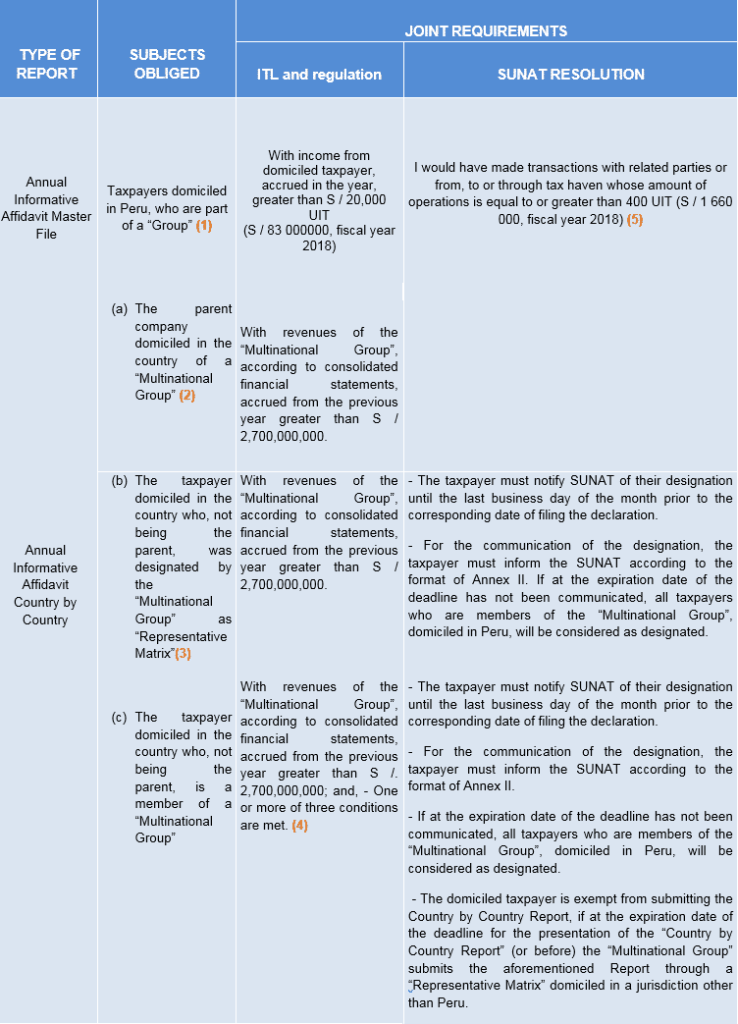

In this sense, the submission of Transfer Pricing reports by annual informative affidavits is mandatory provided that the taxpayer is within the obligation thresholds, which can be seen in the following table:

- “Group”: To the group of people, companies or entities linked by property or control relations, in such a way that it is obliged to formulate consolidated financial statements in accordance with the generally accepted accounting principles or that would be obliged to do so if the shares, participations or other documents representing the assets of such people, companies or entities will be negotiated in centralized negotiation mechanisms

- “Multinational Group”: The group consisting of one or more people, companies or entities domiciled in the country and one or more people companies or entities not domiciled in the country, or that is made up of a person, company or entity domiciled for tax purposes in one jurisdiction and that is taxed in another jurisdiction for activities carried out through a permanent establishment..

- “Representative Matrix”: To the member of a multinational group that has been designated by said group as the sole representative of the parent company in order to present the informative affidavit Country by Country Report, on behalf of the multinational group, in the jurisdiction of address or residence of said member

- Conditions:

- The non-domiciled parent company is not required to present the Country-by-Country Report in its domicile jurisdiction.

- The domicile jurisdiction of the parent company does not have an Agreement between Competent Authorities for the exchange of information with Peru.

- The domicile jurisdiction of the foreign parent has incurred a systematic breach of information exchange.

- The “amount of operations” is the sum, in absolute terms, of the amounts involved in transactions between related parties and from, to or through tax havens, whether they report income, expenses or costs, for the following concepts:

- Revenue accrued in the year that generates taxable income,

- Acquisitions of goods and / or service and any other type of transactions made in the year that:

- Reduce costs or expenses deductible for the determination of Income Tax.

- Not being deductible for the determination of the Income Tax, income is taxed from a Peruvian source for one of the parties.

- In property transfers free of charge, the value of the computable cost of the asset is considered.

- In services rendered free of charge or any other free operation other than the transfer of ownership, the amount to be considered is zero.

- The amount of the consideration paid to the holder of an EIRL or shareholders or partners of legal persons, who work in the business, provided in subsection n) of article 37 of the IR Law is not included.

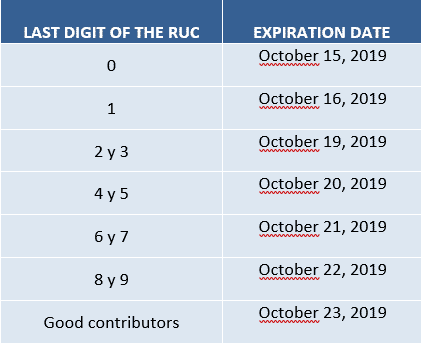

Due dates for submission of affidavits “Master File” and “Country by Country Report”

For any questions and / or additional precision on the aforementioned and other issues within the scope of transfer pricing.

Author: Lady Tomateo-lady.tomateo@tpcgroup-int.com